When asked about their biggest fears, more than half of today’s seniors frequently mention worries about affording senior living options or being a burden on their family near the top of the list.

It makes sense. Coming to terms with the need or desire to transition into a Retirement Community, whether for Independent Living, Assisted Living or Memory Care - no matter how ultimately positive - can feel challenging, emotionally intense and come with the anticipation of great expense. This is especially true if you anticipate the need for assisted living or memory care.

It can be easy for this process to feel so overwhelming that we avoid it until it’s an absolute necessity. However, with seven out of ten Americans over the age of 65 requiring some type of care during their lives, planning ahead can alleviate a tremendous amount of stress.

The Good News:

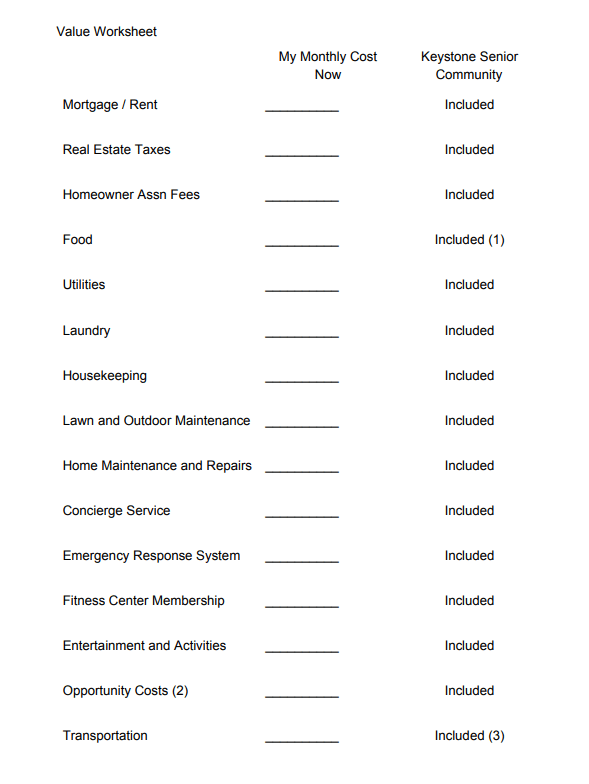

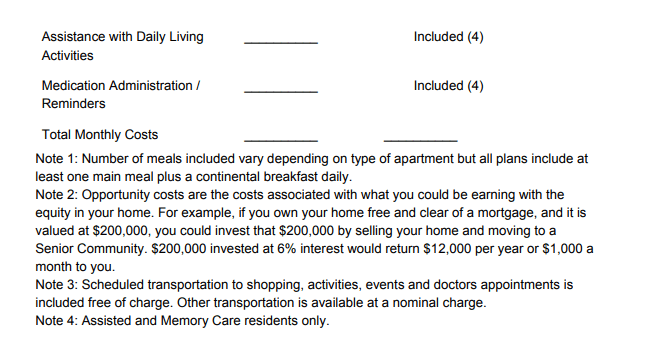

Although it may seem surprising, the cost of living at a Senior Living community is often comparable (or even lower) even without taking into account the included activities, amenities, and services, with the combined expenses of living in a single-family home.

While the investment may at first seem daunting, it is also important to consider the long term costs of maintaining your own residence throughout your senior years. For example, a proactive decision to choose an Assisted Living community can actually be much less expensive than an extended stay in a nursing care center or receiving care at home.

Rest assured, there are countless financial options that can help ease the financial transition to a senior living community.

Todays’ seniors and their families frequently contact us looking for advice on how to afford the cost of senior living without compromising their quality of care.

At Keystone, we aim to support all prospective residents and their families in determining the best path forward to solidifying the financial aspects of securing the perfect location and community. Many of our residents have utilized the following five types of financial alternatives to help cover the costs of our incredible community.

- Long Term Care Insurance

- Veterans Benefits

- Own Home or Assets

- Existing Life Insurance

- Caregiver Tax Credit

1. Long-Term Care Insurance

Although the pricing of living in a Senior Living Community can be surprisingly comparable to maintaining a separate home, many families still find themselves with a gap. Private insurance, Medicare or Medicaid may help, but typically will not cover everything nor is it accepted at many Senior Living Communities. Long Term Care (LTC) Insurance can help bridge that gap but can vary widely from policy to policy. Premiums are normally based on age at the time of purchase, benefit amount, and deductible.

Wading through insurance coverage can be confusing, but a clear understanding of the benefits of your policy is vital to make sure you are able to maximize the coverage you are paying for. For instance, your LTC insurance company may cover only licensed or approved facilities, or require proof that you or your loved one requires assistance with at least two ADLs (Activities of Daily Living) such as bathing, eating or transferring from bed to chair. Often all that is needed a a quick call to your insurance provider to gain clarity on your benefits.

2. Veterans Benefits

Did you/your loved one or a spouse serve in the armed forces? If so, you may want to explore eligibility for benefits through the Department of Veteran’s Affairs. Less than 10% of qualified individuals apply for Veterans Aid and Attendance, which can be used to cover the monthly costs of your senior housing and care, especially if you experienced service-related injuries or disabilities or can demonstrate medical and financial need.

It’s important to note that VA benefits can take 6-9 months to process, and will require military discharge papers and medical documentation; advance planning is important.

3. Your Own Home

If you or your loved one is a homeowner, the house can be sold to cover the costs of living in a Senior Retirement Community. If the time is not right to sell the home, converting it into a long or short term rental can be a great interim step to cover senior living costs.

You may also consider a reverse mortgage if you wish to keep the home in the family. This allows a borrower to draw cash against the equity built up in your home in either a larger lump sum or over a period of time.

The best place to start with exploring either of these options is by contacting a local Real Estate professional that specializes in your market AND with assisting Seniors.

4. Existing Life Insurance

Do you or your loved one have an existing life insurance policy that is no longer needed or wanted? More than 70% of Life Insurance taken out, never pays a claim because people's needs change and they cancel or change their coverage. There are several ways this insurance may be used to ease the cost of living in a Senior Living Community.

- In the advent you or your loved one is in need of Assisted Living Benefits, it is possible the policy has what is commonly referred to as a ‘Living Benefits Rider’. This rider allows the policy owner/insured to receive benefit from the policy now and the remainder would go to beneficiaries.

- In some cases it is possible to sell this policy to an institutional investor - third party for an amount that is greater than the cash surrender value, but less than the total death benefit (usually 15- 40% of the total). This transaction is called a Life Settlement. The process typically takes 3 - 6 months and it is important to utilize a licensed Life Settlement Broker and/or the support of your Financial Advisor. The proceeds from the sale of your policy can then be used toward the costs of your retirement living or anything you desire.

- If you want to keep your policy in place, it may be possible to adjust the payout amount for your beneficiaries, and borrow against the existing cash value. Not all policies allow for this option, so it is necessary to contact your insurance provider or financial advisor.

- You may also be eligible to convert your existing life insurance to a long-term care plan, however, this can significantly reduce your policy value as for death benefit and not all life insurance policies have this conversion feature.

Note: cashing out your life insurance policy and/or participating in a Life Settlement can have income tax implications. Please consult with a tax and financial professional prior to considering these options.

5. Caregiver Tax Credits

If you or your loved one requires assistance with ADLs (Activities of Daily Living) such as eating, dressing or toileting or requires supervision for health and safety due to cognitive impairment (the type of services provided by Assisted Living or Memory Care), you may be eligible to deduct partial or full long term expenses associated with their care as an unreimbursed medical expense. In order to qualify for this deduction, the resident must have been certified as chronically ill by a licensed health care provider. It is also advised you contact your tax profesional to learn more about this Tax Credit.

Don’t put all your eggs in one basket

The five avenues detailed above are just a handful of the options available for helping ease the financial expenses of senior living. Beyond private payments and personal loans, these five options represent a solid starting point for your research - but in no way represent a comprehensive list. Be creative and think outside of the box.

Choose the correct level of care

In most cases, the funding for Retirement, including Independent Living, Assisted Living & Memory Care comes from more than one source. However, no matter the source, it is vitally important to use that funding wisely by choosing the correct level of care.

Choosing the right type of care is an important step in minimizing the costs associated with senior living. For instance, someone needing minimal assistance may still be suited for Independent Living with family or outside providers taking on any additional duties, an option far less expensive than Assisted Living.

Check out our FAQ to compare each type of care and to learn the right level for you or your loved one.

Bottom Line: The most powerful thing you can do to minimize the financial adjustment to Retirement living in a Senior Living Community is to plan ahead

One of the most important ways to navigate the many transitions of senior living is to prepare ahead of time before the need or desire arises. You or your loved one may not be quite ready for the move right now, which makes this the perfect time to begin doing your research and learn about options and how to get the financial end in line, long before it is needed. Waiting till the last minute can intensify the stress of the transition, financially and otherwise, and could mean you end up in a location that isn’t a good fit, increasing the chances of needing to move again - with all of the financial implications.

Even with options, the logistics can be overwhelming. Scheduling a tour and consultation at each senior living community you are considering to fully explore the financial options and assistance available at each community. At Keystone, our Senior Living Counselors are expertly trained in helping you navigate all aspects of Senior Living, including financial.